Indicators on Transaction Advisory Services You Should Know

Table of ContentsThe Ultimate Guide To Transaction Advisory ServicesGetting The Transaction Advisory Services To WorkWhat Does Transaction Advisory Services Do?Transaction Advisory Services Fundamentals ExplainedThe Best Guide To Transaction Advisory Services

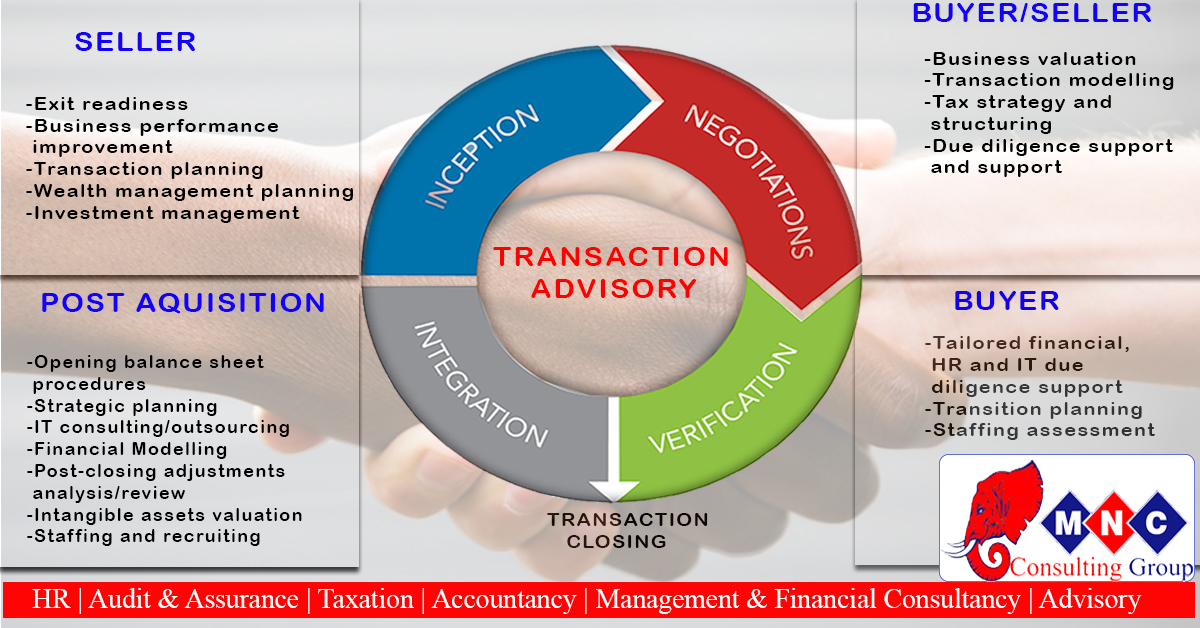

This step makes certain business looks its finest to potential customers. Getting business's value right is essential for an effective sale. Advisors utilize different methods, like discounted cash money circulation (DCF) analysis, contrasting with comparable firms, and recent transactions, to figure out the reasonable market price. This helps establish a fair rate and discuss successfully with future purchasers.Purchase experts step in to assist by getting all the needed info organized, addressing inquiries from customers, and preparing check outs to the service's location. Deal experts use their competence to aid company proprietors deal with challenging arrangements, satisfy buyer assumptions, and framework offers that match the owner's goals.

Satisfying legal regulations is important in any service sale. Purchase consultatory services deal with lawful professionals to create and examine agreements, arrangements, and various other lawful documents. This minimizes threats and makes certain the sale adheres to the legislation. The function of purchase consultants extends past the sale. They help organization proprietors in intending for their next steps, whether it's retirement, beginning a new venture, or managing their newly found wide range.

Deal consultants bring a riches of experience and knowledge, ensuring that every facet of the sale is managed professionally. Through strategic preparation, evaluation, and settlement, TAS aids entrepreneur accomplish the greatest possible price. By guaranteeing legal and governing compliance and managing due persistance alongside various other deal staff member, transaction experts minimize prospective threats and obligations.

The Only Guide for Transaction Advisory Services

By comparison, Huge 4 TS teams: Work with (e.g., when a possible purchaser is carrying out due persistance, or when an offer is closing and the buyer needs to incorporate the firm and re-value the seller's Balance Sheet). Are with fees that are not linked to the deal shutting efficiently. Earn costs per interaction somewhere in the, which is much less than what financial investment financial institutions gain also on "little deals" (but the collection probability is additionally a lot greater).

, however they'll focus more on accountancy and valuation and much less on subjects like LBO modeling., and "accountant only" subjects like test equilibriums and how to stroll via events using debits and debts instead than monetary statement modifications.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

Experts in the TS/ FDD groups may additionally talk to monitoring concerning whatever above, and they'll create an in-depth record with their findings at the end of the process.

The power structure in Deal Solutions varies a bit from the ones in investment banking and personal equity occupations, and the basic form looks like this: The entry-level duty, where you do a great deal of data and economic analysis (2 years for a promotion from here). The following degree up; similar job, but you get the more fascinating bits (3 years for a promo).

Particularly, it's difficult to get advertised beyond the Supervisor degree due to the fact that couple of people leave the work at that stage, and you require to begin showing proof of your capability to generate income to advancement. Allow's start with the hours and way of living because those are less complicated to explain:. There are occasional late evenings and weekend work, but absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living modifications, so anticipate lower look at these guys payment if you remain in a look at more info less expensive location outside significant economic centers. For all settings except Companion, the base pay makes up the mass of the overall compensation; the year-end perk could be a max of 30% of your base income. Often, the most effective means to enhance your profits is to switch to a various company and discuss for a higher wage and bonus

Some Known Factual Statements About Transaction Advisory Services

You could obtain into corporate development, yet investment financial gets a lot more tough at this phase since you'll be over-qualified for Analyst roles. Corporate finance is still an option. At this phase, you need to simply remain and make a run for a Partner-level function. If you intend to leave, perhaps transfer to a customer and perform their valuations and due diligence in-house.

The major problem is that since: You normally require to sign up with another Large 4 team, such as audit, and work there for a couple of years and after that relocate right into TS, job there for a couple of years and afterwards relocate into IB. And there's still no assurance of winning this IB function due to the fact that it relies on your region, clients, and the employing market at the time.

Longer-term, there is likewise some danger of and due to the fact that examining a firm's historic economic details is not exactly rocket science. Yes, humans will always need to be involved, however with even more advanced modern technology, reduced headcounts can possibly support client engagements. That said, the Deal Services team defeats audit in regards to pay, job, and departure possibilities.

If you liked this write-up, you could be curious about analysis.

The Best Strategy To Use For Transaction Advisory Services

Create innovative financial frameworks that assist in establishing the real market price of a firm. Supply advisory operate in relationship to service valuation to help in bargaining and content pricing frameworks. Explain one of the most suitable type of the deal and the kind of consideration to utilize (money, supply, gain out, and others).

Create activity prepare for threat and direct exposure that have actually been recognized. Perform combination planning to establish the process, system, and organizational changes that may be required after the bargain. Make mathematical price quotes of assimilation prices and advantages to examine the financial reasoning of assimilation. Establish guidelines for integrating departments, modern technologies, and service processes.

Recognize potential decreases by reducing DPO, DIO, and DSO. Evaluate the prospective consumer base, sector verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides crucial understandings right into the functioning of the firm to be obtained worrying danger analysis and worth development. Determine temporary alterations to financial resources, financial institutions, and systems.